Jacy J. Wingson, KC to serve as Vice-Chair on the Board of Directors at the Surrey Hospitals Foundation for 2025/2026

Share: November 6, 2025 We’re proud to share that Jacy J. Wingson,…

Read moreBy Parveen Karsan & Zahra Tahsili & Nazanin Lakani

Originally published: August 2, 2023

Updated on January 18, 2024

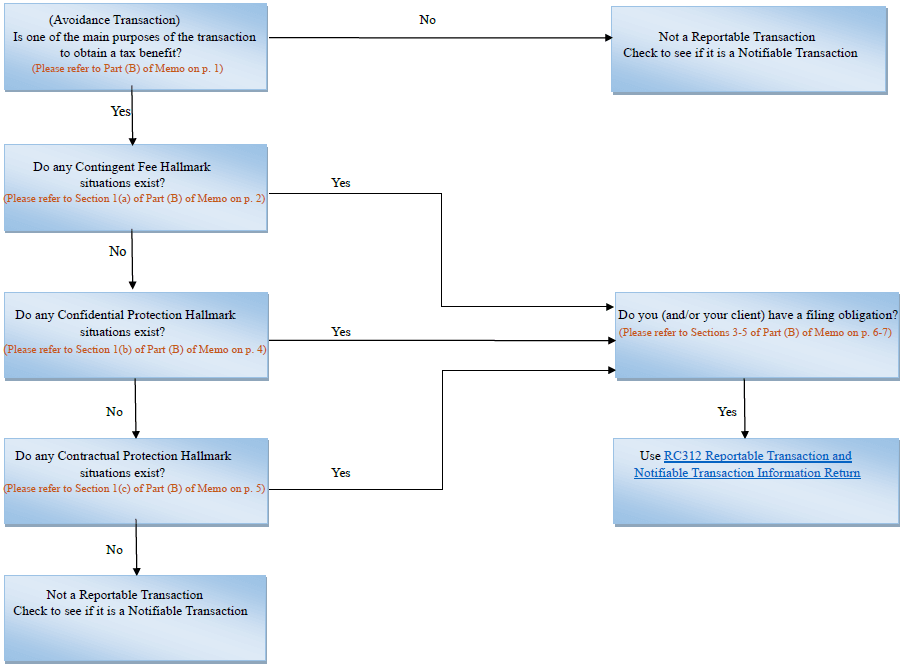

The federal government has expanded the mandatory disclosure rules in the Income Tax Act (“ITA”) by making changes to the reportable transaction rules and introducing a new notifiable transaction regime, as outlined in this Memorandum. Notifiable transactions differ from reportable transactions in that notifiable transactions are those that the Minister of National Revenue specifically designates as requiring reporting, whereas reportable transactions require reporting if certain specified criteria are met.

The primary objective of these amendments is to promote transparency and compliance in tax-related matters. To achieve this goal, the amendments impose specific obligations on taxpayers, advisors, and promoters to provide comprehensive information returns regarding reportable and notifiable transactions to the Canada Revenue Agency (CRA).

The proposed changes have undergone significant legislative progress, with draft legislation being presented on February 4, 2022, and further developments occurring since August 9, 2022. The bill, known as Bill C-47, received Royal Assent on June 22, 2023, transforming the rules in their current form into law.

A “reportable transaction” refers to an avoidance transaction that is entered into by or for the benefit of a person. This includes not only the specific avoidance transaction but also any transaction that is part of a series of transactions (referred hereto as “transaction or series”) that consists of the avoidance transaction.

The mandatory disclosure rules in respect of reportable transactions apply when two criteria are satisfied:

a) A transaction or series has at least one of three generic hallmarks, which will be explained in further detail later in the memorandum; and

b) It can reasonably be concluded that one of the main purposes of entering into the transaction or series of transactions is to obtain a tax benefit.

Before the introduction of changes to the reportable transaction rules, taxpayers were obligated to report transactions that meet the criteria of an “avoidance transaction” as defined in section 245 of the General Anti-Avoidance Rule (GAAR).1 Under this definition, a transaction or series would not be deemed an avoidance transaction if it could be reasonably demonstrated that it was primarily undertaken or arranged for bona fide purposes other than obtaining the tax benefit.

According to the new regime, an “avoidance transaction” is defined as a transaction that may reasonably be considered to have as one of its main purposes, or one of the main purposes of a series of transactions of which it is a part, to obtain a tax benefit. This definition establishes a lower threshold compared to the former definition modelled in the GAAR. This lower threshold implies that a transaction could be classified as an avoidance transaction even if it has additional legitimate purposes or motivations. Therefore, under the new reportable transaction rules, it is important to note that there is no requirement for a transaction to be abusive.

When discussing the avoidance transaction definition, the Department of Finance made the following statement in the explanatory notes to the April 2023 Notice of Ways and Means Motion (the “Explanatory Notes”):

“Normal commercial transactions that do not pose an increased risk of abuse, in and of themselves, are not intended to result in a reporting obligation under these rules.”2

That said, the language of the definition of “avoidance transaction” may catch normal commercial transactions. Whether such transactions pose an increased risk of abuse may be a matter of some controversy.

As discussed, one of the criteria for determining whether a transaction or series is reportable is the presence of at least one of three generic hallmarks. Conversely, if none of the three generic hallmarks, as defined below, are present in a transaction or series, there is no legislative requirement to report it, even if it can be reasonably concluded that one of the main purposes of entering into the transaction or series is to obtain a tax benefit. According to the CRA Guidance released on July 5, 2023 (the “CRA Guidance”), transactions such as estate freezes, debt restructuring, loss consolidation arrangements, shareholder loan repayments, purification transactions, claiming of the capital gain exemption, divisive reorganizations and foreign exchange swaps may not trigger a reporting requirement, though they are typically driven by a desire to obtain tax benefit. This list is not exhaustive.3

The first hallmark pertains to the circumstances where an advisor or promoter is entitled to receive a fee based on the presence of a tax benefit. This hallmark encompasses the following situations:

a) computation of fee is based (to any extent) on the amount of a tax benefit that could result;

b) entitlement to fee contingent upon the obtaining of, or failure to obtain, a tax benefit; or

c) the fee is attributable to the number of persons who

i) enter into the avoidance transaction or

ii) have been provided access to advice or opinion given by the advisor or promoter regarding tax consequences.

According to the CRA Guidance and the Explanatory Notes, the following activities do not trigger the contingent fee hallmark and as a result, are not reportable to the extent the transaction is limited to the circumstances below and no other specific hallmark is met:

a) A fee for the claiming of the scientific research and experimental development (SR&ED) tax credits;

b) A fee for the preparation of an annual income tax return that results in a taxpayer obtaining a refund of tax, including entitlement to personal tax credits, such as the disability tax credit or refundable tax credits, the Canada child benefit, the GST/HST credit or the Canada workers benefit;

c) Fees based on the numbers of preparations of and filings of income tax elections in respect of a transaction or series of transactions. This also extends to the fees for the preparation of the documents effecting those elections when the person in charge of preparing the documents is different than the person filing the elections;

d) In certain circumstances, a firm may bill a fee attributable to the number of taxpayers that participate in or have been provided access to the advice given on the tax consequences of the transaction. It is important to note that the fees must only be contingent on the number of returns or elections prepared, rather than the attainment of a tax benefit. A few examples are outlined below:

e) Value-billing arrangements by professionals such as lawyers and accountants, where a fee is agreed to at the time of billing and is based on criteria other than the value of the tax benefit resulting from the transaction or series, which might include:

f) Contingent tax litigation fee arrangement in relation to an appeal of a tax assessment by a lawyer in respect of a tax benefit from a completed transaction or series.5 Therefore, the litigator would not generally be an advisor in respect of a transaction or series solely because of the existence of the contingent litigation fee arrangement that is implemented after the completion of the transaction or series that is the subject of an appeal. This position would also generally extend to the professional assistance provided to a taxpayer in relation to an audit as well as the issuance of assessments (including proposed reassessments); and

g) Billing practices and circumstances of an advisor in respect of an avoidance transaction involving the collection of a standard fee (generally available to the public under normal commercial terms and in comparable circumstances) by a financial institution:

On this basis, no reporting obligation would generally arise for a financial institution that collects a standard fee in relation to the provision of an ordinary financial account that is broadly offered in a normal commercial or investment context in which parties deal with each other at arm’s length and act prudently, knowledgeably and willingly.

It should be noted that exclusion may not apply where the financial institution can reasonably be expected to know that the financial account will be used in a reportable transaction to their client.6

This applies when an advisor or promoter obtains “confidential protection” regarding an avoidance transaction. “Confidential protection” means anything that prohibits the disclosure to any person or to the Minister of National Revenue (“MNR”) of the details or structure of the transaction.

It is important to note that confidential protection does not include provisions that solely disclaim or restrict an advisor’s liability if the disclosure of transaction details or structure is not prohibited. Furthermore, the requirement for confidential protection to be applicable must relate to the tax treatment of the avoidance transaction.

It may be advisable for lawyers to consider including “notwithstanding language” in their engagement or retainer letters to clarify that any confidentiality clauses contained within their documents should not be interpreted as providing confidential protection under the reportable transaction rules. This issue is elaborated on in detail in the “Recommendations” section of this Memorandum.

In the absence of any other specific hallmark, the CRA Guidance clarifies that the protection of trade secrets unrelated to tax matters does not trigger a reporting obligation. Moreover, standard confidentiality agreements that do not require tax advice to be confidential, such as a letter of intent that includes a confidentiality requirement, do not give rise to a reporting requirement. Similarly, the CRA Guidance stipulates that standard commercial confidentiality provisions in standard client agreements or documentation, which do not contemplate a specific identified tax benefit or tax treatment, do not, in and of themselves, impose a reporting obligation.

The third hallmark applies when a taxpayer or certain other individuals, including promoters or advisers, receive contractual protection if the transaction in question fails to achieve the intended tax benefit. It pertains to transactions that involve insurance or other forms of protection, including an indemnity, compensation or guarantee that:

a) protects against a failure of the transaction or series to achieve any tax benefit; or

b) pays for or reimburses expenses, fees, taxes, interests, penalties, or any other costs that may arise during a dispute related to a tax benefit.

According to the CRA Guidance and the Explanatory Notes, in the absence of any other specific hallmark, the below-listed matters would not give rise to a reporting requirement:

a) A limitation of liability clause in a professional engagement letter, provided that the purpose of the limitation clause is to generally limit the accountant’s liability for negligence (i.e., it is related to professional indemnity insurance).

b) Standard professional liability insurance of a tax practitioner.

c) Standard representations, warranties and guarantees between a vendor and purchaser, as well as traditional representations and warranties insurance policies, that are generally obtained in the ordinary commercial context of mergers and acquisitions transactions to protect a purchaser from pre-sale liabilities (including tax liabilities).7 It is important to note that the Explanatory Notes do not explicitly mention other types of commercial transactions. Therefore, this hallmark may still be applicable where agreements drafted in respect of other commercial transactions, contain tax indemnities and the like.

d) Standard commercial indemnities provisions in standard client agreements or documentation, which do not contemplate a specific identified tax benefit or tax treatment.

e) Tax return insurance – It is our general view that tax return insurance would not constitute contractual protection insofar as the insurance is extended to a taxpayer’s filings generally, and does not contemplate any particular transaction or series entered into by a taxpayer and those who engage in aggressive tax planning would continue to bear potentially significant financial risks associated with such activities. The insurance would not pay for or reimburse taxpayers for tax imposed as a result of disputed tax positions in respect of aggressive tax planning, and it is subject to maximum amount of coverage (or protection) which would not likely cover a material portion of the total expenses incurred by a taxpayer as a result of an audit in respect of aggressive tax planning.

f) Re-insurance – For greater certainty, where the original insurance policy is not subject to a reporting obligation, the reinsurance of the risk generally should not cause further reporting.

g) A reporting obligation would not arise solely in respect of contractual protection in the form of insurance that is integral to an agreement between persons acting at arm’s length for the sale of a business8 where it is reasonable to conclude that the insurance protection is intended to ensure that the purchase price paid under the agreement takes into account any liabilities of the business immediately prior to the sale and the insurance is obtained primarily for purposes other than to obtain a tax benefit from the transaction or series.

It should be noted that this exception does not extend to other forms of insurance or protections that may be obtained to cover specific identified tax risks (other than the risks specifically discussed above), such as tax liability insurance policies used in avoidance transactions. The existence of such insurance may often be an indication of aggressive tax planning.

h) Standard price adjustment clauses, as discussed in the Income Tax Folio S4-F3-C1.9

i) Other price adjustment clauses that are not tax-driven (such as a working capital adjustment clause in a Purchase and Sale Agreement).

j) Obtaining an advance income tax ruling from the CRA or other tax administrations on non-Canadian tax issues, by a person seeking a tax benefit from an avoidance transaction or series of transactions involving an avoidance transaction.

k) Contingent litigation fee arrangement in relation to an appeal of a tax assessment by a lawyer in respect of a tax benefit from a completed transaction or series. This position would also generally extend to the professional assistance provided to a taxpayer in relation to an audit as well as the issuance of assessments (including proposed reassessments).

l) Withholding tax – Standard contractual representations and indemnities with respect to the failure to deduct or withhold an amount under section 215, in an arm’s length situation.

m) Partnership investment – For greater certainty, a partnership agreement containing a standard clause to the effect that, in the event of an audit of a partner, the partnership will provide reasonable assistance to that partner to help them resolve such an audit generally would not be considered to meet the contractual protection hallmark. However, the contractual protection hallmark would be met if the purpose of the clause contemplates any particular avoidance transaction or series (including an avoidance transaction).

n) Mutual fund merger (where an investment fund manager merges two investment funds within a fund family) – The merger is structured to be tax-deferred pursuant to section 132.2 of ITA such that the surviving fund acquires the assets of the terminating fund. If under the terms of the merger agreement, the fund manager agrees to indemnify the trustee of the terminating fund for any liabilities that might arise in respect of the terminating fund (commercial disputes, securities law claims, etc.) such indemnity would not constitute contractual protection.

o) The contractual protection hallmark will not apply in a normal commercial or investment context in which parties deal with each other at arm’s length and act prudently, knowledgeably and willingly, and does not extend contractual protection for a tax treatment in respect of an avoidance transaction. Without providing an exhaustive list of examples, these can include:

Disclosure under the reportable transaction regime is not required for the acquisition of a tax shelter or the issuance of a flow-through share where the appropriate information return has been filed. Please consult with your tax advisor.

According to the reportable transaction rules, several parties have an obligation to file information returns with the appropriate authorities. These include:

a) Every person for whom a tax benefit results or is expected to result from the reportable transaction or series;

b) Advisors and promoters who are entitled to a fee in respect of the reportable transaction or series; and

c) Every person who is not dealing at arm’s length with the advisors or promoters, and is entitled to a fee in respect of the transaction or series.

It is important to note that clerical or secretarial services are excluded from the filing obligation. Additionally, it is worth emphasizing that each obligated person is responsible for fulfilling their individual reporting obligations.

For a partnership or employer who receives a fee as an advisor or promoter in respect of an avoidance transaction and discloses a reportable transaction as required, its partners or employees including in-house tax advisors would generally not also need to make a disclosure. The foregoing also applies to an individual who provides services as an employee of a professional corporation that is a partner of the relevant partnership, directors of a corporation and former employees or former partners.

In the context of reportable transactions, an advisor refers to any person who provides, directly or indirectly, in any manner whatever:

to another person (including any person who enters into the transaction for the benefit of another person).

A promoter, in respect of a transaction or series, means each person who

a) promotes or sells (whether as principal or agent and whether directly or indirectly) an arrangement, plan or scheme (referred to as an “arrangement”), if it may reasonably be considered that the arrangement includes or relates to the transaction or series;

b) makes a statement or representation (whether as principal or agent and whether directly or indirectly) that a tax benefit could result from an arrangement, if it may reasonably be considered that

ii) the statement or representation was made in furtherance of the promoting or selling of the arrangement, and

iii) the arrangement includes or relates to the transaction or series; or

c) accepts (whether as principal or agent and whether directly or indirectly) consideration in respect of an arrangement referred to in paragraph (a) or (b) above.

Taxpayers, advisors, and promoters must file information about reportable transactions within 90 days of the earlier of:

a) the date on which the person becomes contractually obligated to enter into the transaction; and

b) the date on which the person actually enters into the transaction.

The revised rules governing reportable transactions are applicable to transactions or series that occur after royal assent, which took place on June 22, 2023. This means that if an individual enters into a contract for a reportable transaction on June 1, 2023, but the actual transaction occurs on June 30, they are still obligated to report it, and the 90-day reporting period will begin on June 30, 2023. Similarly, if a person is involved in a series of transactions that span the date of royal assent, the reporting requirement will be triggered by the first reportable transaction entered into after the date of royal assent.10

Reportable transactions are required to be disclosed to the CRA in the prescribed form, RC312 Reportable Transaction and Notifiable Transaction Information Return.

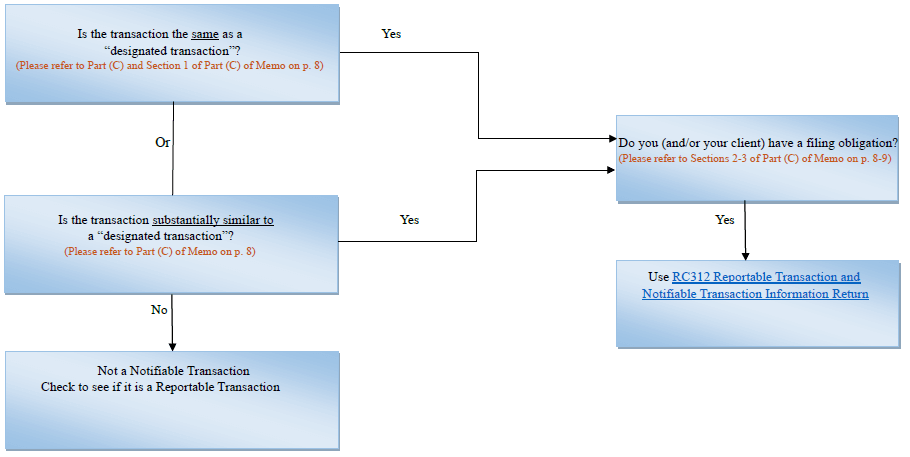

Under the new regime, there is an obligation to report transactions or series that are designated as “notifiable” transactions as well as transactions that are “substantially similar” to notifiable transactions. The term “substantially similar” is defined as encompassing transactions or series that are expected to result in “the same or similar types of tax consequences” and are “either factually similar or based on the same or similar tax strategy”. The legislation expressly states that “substantially similar” should be “interpreted broadly in favour of disclosure”.11

Effective November 1, 2023, the Minister of National Revenue with the Concurrence of the Minister of Finance, designated the following transactions and series of transactions as notifiable transactions. The descriptions and examples provided are directly quoted from the CRA’s publication:12

The following series of transactions has been designated as a notifiable transaction:

a. A taxpayer enters into an agreement to acquire a partnership interest from an existing partner.

b. The partnership trades foreign exchange forward purchase and sale agreements on margin through a foreign exchange trading account. The foreign exchange forward agreements are essentially straddle transactions where it is reasonable to conclude that each agreement is held in connection with the other and where, in the aggregate, the individual agreements (legs) will generate substantially equal and offsetting gains and losses.

c. Shortly before the taxpayer’s acquisition of the interest in the partnership, the partnership disposes of the gain leg(s) of the foreign exchange forward agreement(s).

d. The income from the gain leg(s) is then reflected in the income of the partnership and is allocated to the original partner immediately prior to the acquisition of the interest in the partnership by the taxpayer.

e. Following the acquisition of the partnership interest by the taxpayer, the loss leg(s) are realized and a business loss is allocated to the taxpayer.

The following transactions and series of transactions have been designated as notifiable transactions:

a. Indirect transfer of trust property to another trust

A Canadian resident trust (“New Trust”) holds shares of a corporation resident in Canada (“Holdco”) that is or will become a beneficiary of another Canadian resident trust (“Old Trust”) that holds property that is capital property or land included in the inventory of a business of Old Trust. At any time prior to its 21-year anniversary, Old Trust transfers the property to Holdco on a tax deferred basis pursuant to subsection 107(2).

In the result, the 21-year rule will not apply to Old Trust, and a new 21-year period will start to run with respect to New Trust, providing for a much longer period of deferral. New Trust’s assets will reflect the property formerly held by Old Trust but may have a higher tax basis than such property.

b. Indirect transfer of trust property to a non-resident

One or more of the non-resident beneficiaries of a Canadian resident trust hold shares of a corporation resident in Canada (“Holdco”) that is or will become a beneficiary of the trust. At any time prior to its 21-year anniversary, the trust transfers property (other than property described in any of subparagraphs 128.1(4)(b)(i) to (iii)) to Holdco on a tax deferred basis pursuant to subsection 107(2).

In the result, the 21-year rule will not apply to the trust, with the transfer of the trust’s property to Holdco providing for a much longer period of deferral. The non-resident beneficiaries of the trust hold shares of Holdco that reflect their former indirect interest in the property of the trust, possibly providing an opportunity to have such property transferred by Holdco to the non-resident beneficiaries at some future time without triggering the application of subsections 107(2.1) and 107(5).

c. Transfer of trust value using a dividend

A Canadian resident trust (“New Trust”) holds shares of a corporation (“Holdco”) that is or will become a beneficiary of another Canadian resident trust (“Old Trust”) that holds property that is shares in a Canadian corporation (“Opco”). At any time prior to Old Trust’s 21-year anniversary, Opco redeems shares held by Old Trust and issues a promissory note or gives cash as consideration. In so doing, Opco is deemed pursuant to subsection 84(3) to have paid, and Old Trust is deemed to have received, a dividend equal to the amount by which the amount paid by Opco on the redemption exceeds the PUC in respect of the shares. The deemed dividend is designated by Old Trust and deemed to be received by Holdco pursuant to subsection 104(19). The dividend is deductible in the hands of Holdco pursuant to subsection 112(1). The cash or the promissory note is paid or made payable in the year by Old Trust to Holdco as payment for the dividend allocated to it.

In the result, the 21-year rule will not apply to Old Trust, and a new 21-year period will start to run for New Trust, providing for a much longer period of deferral. New Trust’s assets will reflect the value of the property formerly held by Old Trust but will undoubtedly have a significantly higher tax basis than such property.

The following series of transactions has been designated as a notifiable transaction:

a. A person or partnership (“Debtor”) is assigned into bankruptcy.

b. While Debtor is a bankrupt, a commercial obligation of the Debtor is settled, deemed to be settled or extinguished for an amount that is less than the principal amount of the obligation.

c. At any point in time, Debtor files a proposal under Part III of the Bankruptcy and Insolvency Act and the bankruptcy is annulled either upon the approval of the proposal by a court or on the date stated in a court order.

The following transactions and series of transactions have been designated as notifiable transactions:

a. Purpose test in paragraph 256.1(2)(d)

Lossco is a taxable Canadian corporation that has tax attributes that are subject to the application of one of the provisions listed in the definition of “attribute trading restriction” in subsection 256.1(1). Another person (“Aco”) does not, immediately before the particular time, hold shares of Lossco with a FMV that satisfies the 75% FMV threshold test. At a particular time, Aco acquires shares of Lossco and, following the acquisition, Aco does not control Lossco but satisfies the 75% FMV threshold test. The taxpayer takes the position that because the purpose test in paragraph 256.1(2)(d) is not satisfied, subsection 256.1(3) does not apply.

b. Purpose test in paragraph 256.1(4)(a)

Lossco is a taxable Canadian corporation that has tax attributes that are subject to the application of one of the provisions listed in the definition of “attribute trading restriction” in subsection 256.1(1). A corporation (“Profitco”) and another person (“Aco”) not dealing at arm’s length with Profitco acquire shares of Lossco. Following the acquisition of the Lossco shares, Profitco does not control Lossco and does not hold shares of Lossco with a FMV that satisfies the 75% FMV threshold test. However, Profitco would satisfy the 75% FMV threshold test if the acquisition of the Lossco shares by Aco is ignored. The taxpayer takes the position that subsection 256.1(3) does not apply solely because the purpose test in paragraph 256.1(4)(a) is not satisfied.

c. Purpose test in paragraph 256.1(6)

Lossco is a taxable Canadian corporation that has tax attributes that are subject to the application of one of the provisions listed in the definition of “attribute trading restriction” in subsection 256.1(1). Lossco acquires control of a particular corporation (“Profitco”) and it can reasonably be concluded that one of the reasons for the acquisition is so that a specified provision as defined in subsection 256.1(1) does not apply. However, the taxpayers take the position that subsection 256.1(6) does not apply solely because its purpose test is not satisfied.

The following transactions and series of transactions have been designated as notifiable transactions:

a. Thin capitalization

Non-resident 1 (NR1) is a relevant non-resident in respect of a taxpayer. NR1 enters into an arrangement with an arm’s length non-resident (NR2) to indirectly provide financing to the taxpayer. The taxpayer files, or anticipates filing, its income tax returns on the basis that the debt or other obligation owing by it, and the interest paid thereon, is not subject to the thin capitalization rules.

b. Part XIII tax

A non-resident person (NR1) enters into an arrangement to indirectly provide financing to a taxpayer through another non-resident person (NR2). If interest had been paid by the taxpayer directly to NR1, it would be subject to Part XIII tax. The taxpayer’s income tax reporting reflects, or is expected to reflect, the assumption that the interest it pays in respect of the arrangement is either not subject to withholding tax at all or is subject to a lower rate of withholding tax than the rate that would apply on interest paid directly by it to NR1.

Alternatively, similar arrangements are entered into in respect of rents, royalties or other payments of a similar nature, or to effect a substitution of the character of the payments.

Similar to the new reportable rules, the following parties have the obligation to file information returns:

a) Every person for whom a tax benefit results, or for whom a tax benefit is expected to result based on the person’s tax treatment of the notifiable transaction, from the notifiable transaction or series;

b) Every person who enters into a notifiable transaction for the benefit of a person described in (a);

c) Every advisor or promoter in respect of the notifiable transaction; and

d) Every person not dealing at arm’s length with an advisor or promoter in respect of the notifiable transaction and who is or was entitled to a fee in respect of the notifiable transaction.

As with the reportable transaction rules, there is no filing requirement if a person provides clerical or secretarial services only.

Under the notifiable transaction rules, the definition of an advisor includes any person who provides any assistance or advice with respect to creating, developing, planning, organizing or implementing the notifiable transaction to another person. Additionally, anyone who provides assistance or advice to any promoter or any other advisor in respect of the transaction is an advisor.

The definition of promotor with respect to the notifiable transaction rules is the same as the definition of promoter for the reportable transactions rules.

It is important to highlight that, unlike the reportable transaction rules, an advisor or promoter does not necessarily need to be entitled to a fee to be caught by the notifiable transaction rules. There can be more than one advisor in respect of a notifiable transaction or series, each of whom may be subject to a filing obligation. However, a person that provides advice or representation in respect of an audit or tax dispute is excluded from the definition of an advisor or promoter, unless they are otherwise involved in the notifiable transaction.

A taxpayer who enters into a notifiable transaction or another person who enters into such a transaction in order to procure a tax benefit for the taxpayer must file information returns within 90 days of the earlier of the date on which the taxpayer (or a person who entered into the transaction for the benefit of the taxpayer) becomes contractually obligated to enter into the notifiable transaction and the day on which the taxpayer (or a person who entered into the transaction for the benefit of the taxpayer) enters into the notifiable transaction.

The prescribed form for disclosing the notifiable to the CRA is RC312 Reportable Transaction and Notifiable Transaction Information Return. The relevant person would indicate on Form 312 that the transaction is a reportable transaction, a notifiable transaction or both. For notifiable transactions, the relevant person has to complete Part 3, “Notifiable transaction” and then continue with Part 5, “Penalty” of the form.13

Under the filing requirements for notifiable transactions, a separate information return is required for each transaction within a series. However, in some cases, a single information return that provides details of every transaction within the series may be sufficient.

Like the reportable transaction regime, each person who is affected by the notifiable transaction is required to file an information return. Employees and partners are deemed to have met their reporting requirement when the employer or partnership has filed the required information return. The foregoing also applies to an individual who provides services as an employee of a professional corporation that is a partner of the relevant partnership, directors of a corporation and former employees or former partners.

A person who obtains or expects to obtain a tax benefit from a notifiable transaction and for taxpayers entering into such transactions for their own benefit, a defence against penalties imposed for failure to comply with reporting requirements may be available, if they have exercised a degree of care, diligence, and skill in determining whether the transaction qualifies as a notifiable transaction. This exemption recognizes that if a person has taken reasonable measures to assess the nature of the transaction and has acted in a manner that a reasonably prudent person would in comparable circumstances, there is no obligation to file an information return. For example, this defence may be available where the taxpayer seeks the opinion of their advisors regarding potential reporting obligations and is informed by the advisors that there is no requirement to file.

For advisors, promoters, or persons not at arm’s length with advisors or promoters who are entitled to a fee, the due diligence defence may be available where it can be established that the person does not know or should not reasonably be expected to know that the transaction qualifies as a notifiable transaction.

The determination of what a person should “reasonably be expected to know” is assessed objectively, taking into account all the relevant facts and circumstances. It does not rely on the person’s subjective intention or knowledge alone. The question is whether a reasonable person, in the same position and having the same knowledge and information, would be aware that the transaction meets the criteria for being considered a notifiable transaction.

Advisors who provide ancillary services or have narrow mandates may not be expected to know that a transaction is a notifiable transaction, depending on the nature of their involvement and expertise. This applies particularly to members of a team with limited involvement or knowledge of the transaction or series, such as junior employees with specific and focused roles.

Failure to report or late filing of a reportable or notifiable transaction can result in penalties imposed on taxpayers. The specific penalties are as follows:

b) For taxpayers:

i) $500 per week for each failure to report a reportable or notifiable transaction, up to the greater of $25,000 and 25% of the tax benefit, or

ii) for a corporation with assets having a total carrying value of $50 million or more for its last taxation year that ends prior to the day on which the information return is required to be filed: a penalty of $2,000 per week for each failure to report a reportable or notifiable transaction, up to the greater of $100,000 and 25% of the tax benefit.

c) For advisors, promoters or persons not at arm’s length with advisors or promoters who are entitled to a fee: a total of

i) 100% of the fees charged by that person in respect of the reportable or notifiable transaction,

ii) $10,000, and

iii) $1,000 per day that the person fails to report the reportable or notifiable transaction, up to a maximum of $100,000.

In order to avoid imposing two sets of penalties upon a person who both 1) enters into a reportable or notifiable transaction for the benefit of another person, and 2) is a person who does not deal at arm’s length with an advisor or promoter in respect of the reportable or notifiable transaction and is entitled to a fee, the legislation provides that such a person would be subject only to the greater of these two penalties.

It is unclear whether professional liability insurance would cover the above penalties. We would recommend that affected parties clarify this with their insurance providers.

It should be noted that when required filings for a notifiable transaction are not made, the Minister has the authority to take certain additional measures, which may include denying tax benefits that could result from the notifiable transaction. Moreover, the Minister can reassess a participant in a notifiable transaction outside of the normal reassessment period for a taxation year in respect of the transaction.

According to the CRA Guidance and the relevant provisions, the information is not required to be disclosed if it is reasonable to believe that the information is subject to solicitor-client privilege.14

1. As so many transactions could potentially be in play due to these new rules, it is prudent to review and update the firm’s Engagement Letters, Closing Agenda, Transaction Checklists and Reporting Letters.

2. A step may be added to the Closing Agenda and Transaction Checklists to include a review of the transaction for possible reporting requirements.

3. As the CRA announces designated transactions, taxpayers must promptly respond to meet their reporting obligations. This means identifying any planned and pending transactions that fall under these rules and providing the necessary information within 90 days of entering into these transactions.

4. Advisors participating in creating, planning, or implementing a reportable or notifiable transaction should understand their primary duty to uphold the confidentiality of their clients’ information. If the advisor is required by law to disclose confidential information, the advisor must communicate this to the client in writing, informing them of the potential disclosure to the CRA. The client should be fully informed about the nature of the information that might be disclosed, the circumstances under which it may happen, and the potential risks associated with such disclosure.

—

[1] Section 245(3): An avoidance transaction means any transaction

(a) that, but for this section, would result, directly or indirectly, in a tax benefit, unless the transaction may reasonably be considered to have been undertaken or arranged primarily for bona fide purposes other than to obtain the tax benefit; or

(b) that is part of a series of transactions, which series, but for this section, would result, directly or indirectly, in a tax benefit, unless the transaction may reasonably be considered to have been undertaken or arranged primarily for bona fide purposes other than to obtain the tax benefit.

[2] M.P. Deputy Prime Minister and Minister of Finance, “Explanatory Notes Relating to the Income Tax Act and Other Legislation”, published by The Honourable Chrystia Freeland, P.C., April 2023, at p 71, available at: https://fin.canada.ca/drleg-apl/2023/nwmm-amvm-0423-eng.html.

[3] Canada Revenue Agency, “Mandatory disclosure rules – Guidance” (Last modified: November 2, 2023), available at: https://www.canada.ca/en/revenue-agency/programs/about-canada-revenue-agency-cra/compliance/mandatory-disclosure-rules-overview/guidance-document.html

[4] Ibid.

[5] Ibid.

[6] Supra Note 2 at p. 76.

[7] Ibid at p. 73.

[8] For greater certainty, this contemplates an indirect sale of all or part of a business which would include:

[9] The CRA has previously characterized the price adjustment clauses as provisions that can potentially prevent adverse tax consequences (in other words, to protect against the failure to achieve a tax benefit).

[10] Supra Note 3.

[11] Department of Finance, “Legislative proposals relating to the Income Tax Act and the Income Tax Regulations (Budget 2022 and other proposals)” (October 10, 2020), available at: https://fin.canada.ca/drleg-apl/2022/ita-lir-0822-l-2-eng.html.

[12] Canada Revenue Agency, “Notifiable transactions designated by the Minister of National Revenue” (November 01, 2023), available at: https://www.canada.ca/en/revenue-agency/programs/about-canada-revenue-agency-cra/compliance/mandatory-disclosure-rules-overview/notifiable-transactions-designated-by-minister-national-revenue.html

[13] Supra Note 3.

[14] Supra Note 3.

Share: November 6, 2025 We’re proud to share that Jacy J. Wingson,…

Read moreShare: October 30, 2025 McQuarrie has been recognized in the 2026 edition…

Read moreShare: October 24, 2025 Our BC municipalities are constantly changing and growing…

Read more